Declaration

Declaration for Life Policy

The foregoing statement and answers are full, complete and true. I agree that these statements shall be the basis of the contract of this policy between myself and Ceylinco Life Insurance Limited and that they shall not be liable for any claim on account of illness, injury or death, the cause of which was known prior to approval of my request for this assurance and that I have not withheld or concealed any material facts in the above statement.

Further, I authorize any representatives of Ceylinco Life Insurance Limited to obtain the bed-head ticket or any other clinical notes from any Private or Government Hospital Clinic, Nursing Home, Asylum or Sanatorium, if necessary. I also authorize them to obtain information from any insurer.

I hereby give my consent to Ceylinco Life Insurance Limited to verify (Online/Manual) my National Identity Card particulars with the Department of Registration of Persons.

I agree and consent to Ceylinco Life Insurance Limited as well as their respective representatives, agents, the Company's authorized service providers and relevant third parties whether within or outside Sri Lanka to collecting, using and/or disclosing my personal data for purposes reasonably required by the Company to evaluate my proposal and to provide the products or services which I am applying for.

Declaration for Retirement Policy

The foregoing statement and answers are full, complete and true. I agree that these statements shall be the basis of the contract of this policy between myself and Ceylinco Life Insurance Limited and that I have not withheld or concealed any material facts in the above declaration.

Further, I authorize any representatives of Ceylinco Life Insurance Limited to obtain the bed-head ticket or any other clinical notes from any Private or Government Hospital Clinic, Nursing Home, Asylum or Sanatorium, if necessary. I also authorize them to obtain information from any insurer.

I hereby give my consent to Ceylinco Life Insurance Limited to verify (Online/Manual) my National Identity Card particulars with the Department of Registration of Persons.

I agree and consent to Ceylinco Life Insurance Limited as well as their respective representatives, agents, the Company's authorized service providers and relevant third parties whether within or outside Sri Lanka to collecting, using and/or disclosing my personal data for purposes reasonably required by the Company to evaluate my proposal and to provide the products or services which I am applying for.

Declaration for Investment Oriented Life Plan Policy

The foregoing statement and answers are full, complete and true. I agree that these statements shall be the basis of the contract of this policy between myself and Ceylinco Life Insurance Limited and that I have not withheld or concealed any material facts in the above declaration.

Further, I authorize any representatives of Ceylinco Life Insurance Limited to obtain the bed-head ticket or any other clinical notes from any Private or Government Hospital Clinic, Nursing Home, Asylum or Sanatorium, if necessary. I also authorize them to obtain information from any insurer.

I hereby give my consent to Ceylinco Life Insurance Limited to verify (Online/Manual) my National Identity Card particulars with the Department of Registration of Persons.

I agree and consent to Ceylinco Life Insurance Limited as well as their respective representatives, agents, the Company's authorized service providers and relevant third parties whether within or outside Sri Lanka to collecting, using and/or disclosing my personal data for purposes reasonably required by the Company to evaluate my proposal and to provide the products or services which I am applying for.

I also give my consent to Ceylinco Life Insurance Limited to renew the policy at maturity date until I decide to withdraw the maturity proceeds. The beneficiary named in this contract also remains unchanged until further notice.

POLICY CONTRACT

WHEREAS Ceylinco Life Insurance Limited, 'The Company' has agreed with the Assured named in the Schedule annexed to the Policy of Assurance andon the date specified therein, as per the terms and conditions stipulated in the said Policy, co grant unto the said Policyholder, the benefit(s) more fully described in the said Schedule subject to the payment of premia therein and upon the age of the Life Assured being admitted.

The information disclosed by the Assured/Life Assured in the proposal form, and in all declarations shall be the basis of the Contract of Assurance.

The Contract has been entered into in good faith. Therefore, in the event of fraud or misrepresentation by the Assured or the Life Assured, the Company reserves the right to declare the Policy as null and void.

The terms and conditions applicable to the particular contract of Assurance shall be those embodied in the Policy in question and the benefits due thereunder shall be only chose specified in the Schedule annexed thereto.

1. GENERAL POLICY PRIVILEGES & CONDITIONS

The Laws of Sri Lanka shall govern this Policy. Where the context admits, reference to the Assured includes reference to his personal representatives, and the singular includes the plural and the masculine includes the feminine and vice versa.

1.1 RESIDENCE, TRAVEL & OCCUPATION

No restrictions are placed on the Life Assured as regards, residence, travel and occupation, unless otherwise provided for in the schedule.

1.2 INCONTESTABILITY

When the Policy has been in force for a period of two (2) years from the date of its commencement, the Company will not contest the Policy unless there is proof that the Assured made fraudulent statements of a material nature, in order to induce the Company into forming a contract under this Policy with the Assured.

1.3 SURRENDER VALUE

This Policy will not acquire a Surrender Value.

1.4 MATURITY VALUE

There will be no maturity benefit under this Policy on the expiry date.

1.5 BONUS

This Policy is a non participating Policy and will NOT be entitled to share in the surpluses distributed to the Participating Policyholders of the Company.

1.6 PROOF OF AGE

Satisfactory proof of the date of birth of the Assured must be given before any payment is made by the Company under the Policy.

If the age is found to be incorrect, the Company will exercise the right to deal with the Policy as it deems fit.

1.7 APPOINTMENT OF BENEFICIARY

During the lifetime of the Assured and while this Policy is in force, the Assured may by filing a written notice acceptable to the Company, appoint a Beneficiary under this Policy or change any duly appointed Beneficiary at will. Subject to the provisions of any law, a change of Beneficiary shall be effective only if recorded by the Company.

When the Beneficiary is so changed and recorded, the change shall be deemed effective from the date of the written notice. Not withstanding the death of the Assured. The receipt by the Beneficiary of sums payable by the Company, shall constitute a valid discharge of the Company’s liabilities under this Policy and any acknowledgement of such receipt by the Beneficiary thereto shall be conclusive evidence of the same.

If at the time of the death of the Assured there is no Beneficiary living, then the amount payable will be paid to the policy owner or his estate. If the Assured mortgages, charges or grants any other security interest in respect of this Policy the rights of the Beneficiary will be subordinated to the rights of the person entitled to such security interest who will, to the extent of this interest, be encircled co receive the amount payable on the death of the Assured.

1.8 CLAIMS

No money shall become due under the Policy until the Company’s requirements have been complied with and any expenses incurred in this regard should be borne by the claimant. Any payment to be made under this Policy will be made ac the Head Office of the Company. However. the Company is at liberty to nominate at its discretion an alternate place of settlement within Sri Lanka at any time before a claim is settled.

1.9 TOTAL EXCLUSION OF LIABILITY IN CERTAIN EVENTS

If the death of the Assured should occur as a result of engaging in or participating in any way or any manner in any war or war like operation (whether war be declared or not). civil war, rebellion, insurrection, any terrorist activity, civil commotion, military or usurped power, riot, mutiny, invasion, acc of foreign enemies or any act against any lawfully constituted authority, the Company shall not be liable co make any payment what so ever under the Policy. Whenever the Company disclaims liability under this clause, the burden of proving that the death complained of was not occasioned or did not result from any of the causes referred to above. Shall be on the person claiming any benefit under the Policy.

1.10 AIDS

No benefit shall be payable under this Policy when, on the basis of medical evidence available, it is established that the death of the Assured was directly or indirectly due co Acquired Immune Deficiency Syndrome (AIDS) or infection by any Human Immunodeficiency Virus (HIV).

1.11 SUICIDE

If the Assured should die by his own hand while of sound or unsound mind within one (1) year from the date of issue of the Policy this Assurance shall be void except to the extent of bona fide interests of duly registered lending institutions to the extent chat such increase of such lending institution is not covered by any other collateral, for value given to the assured and notice thereof has been given in writing to the Company at least one calendar month before the date of death.

This amount will not exceed the amount which would otherwise be payable upon death of the assured.

1.12 MISSING PERSON

Where the death of the Assured is sought to be established on the basis of a presumption generated in circumstances where he had not been heard of for a period of one year by chose who would have naturally heard of him if he had been alive, no money shall become due under the Policy until the effluxion of a period of 7 years computed from the time when the Assured had ceased to be heard of and this fact notified to the Company.

1.13 RIGHT OF CANCELLATION

The life assurance policy may be cancelled by returning the policy document and providing a written notice to the company within 21 days from the date of commencement of the policy as indicated in the schedule. In the event of cancellation, the company will refund all premiums paid during the period. If the company has incurred any medical expenses, that can be deducted when doing the refund in the event of a policy cancellation.

1.14 MAXIMUM BENEFIT AMOUNT

The maximum sum assured allowable under this plan of assurance on any one life shall not exceed Rupees Two Million (Rs. 2, OOO, OOO).

CEYLINCO LIFE RETIREMENT FUND

WHEREAS Ceylinco Life Insurance Limited, (“The Company”) has agreed with the Policyholder (Assured) named in the schedule annexed to the Policy of Assurance and on the date specified therein, as per the terms and conditions stipulated in the said Policy, to grant unto the said Policyholder, the benefit or benefits more fully described in the said schedule subject to the payment of the premia therein stipulated, and upon the age of the Life Assured being admitted.

AND WHEREAS this document contains conditions and clauses applicable to all Ceylinco Life Retirement Funds. The information disclosed by the assured in the proposal form, shall be the basis of the contract of assurance.

THE terms and conditions applicable to the particular contract of insurance shall be those embodied in the Policy in question and the benefits due thereunder shall be only those specified in the schedule annexed thereto.

Subject to the terms and conditions hereinafter mentioned, the Ceylinco Life Insurance Limited (Hereinafter called “the Company”) agrees with the Assured (referred to in the schedule which is annexed herewith) to pay a benefit in accordance with the choice of the Assured, as set out Hereinafter, provided such Assured or a beneficiary nominated by him/her is alive on the date of retirement stipulated in the schedule.

This contract has been entered in to between the parties referred to above on the basis of the representation made by the Assured in the application form and his undertaking to pay the premia as agreed.

The terms herein set out and the contents of the application referred to above shall constitute the entire contract entered into between the parties.

1. INTERPRETATION

Unless otherwise stated, the following words and phrases used in this document shall have the meaning attributed to them hereunder.

“Written request” means a request in writing duly signed by the Assured and delivered at the Head / Branch Office of the Company.

“Date of Retirement” is the policy anniversary date in the year selected by the Assured for commencement of retirement benefits.

“Commencement date” is the date on which the first premium becomes payable under the contract.

“Policy Year” will be determined based on the number of years premiums paid on the policy.

“Top-up Premium” means an amount paid by the policyholder at irregular intervals in addition to the regular premium specified in the policy.

2. INDIVIDUAL FUND (IF)

For the purpose of determining the benefits under this contract, the Company shall maintain an Individual Fund (herein after referred to as “IF”) on behalf of the Assured. From the premia received, the Company shall be entitled to deduct charges towards defraying the expenses relating to the issuance of this contract. The balance sum shall be credited to the IF.

3. ACCUMULATION RATE

The Company shall, at the beginning of each calendar month, announce a accumulation rate applicable to each IF for the ensuing month. The IF balance shall be updated monthly, using the accumulation rate applicable.

4. CHARGES TO THE IF

The following charges will be debited to the IF.

a) An amount equal to 2% of all premia paid will be deducted before allocating any premia received to the IF.

b) A management fee equal to 0.075% of the IF balance will be charged at the end of each month during the first ten (10) policy years. This will be reduced to 0.05% thereafter.

5. DEFERMENT PERIOD

Deferment period is the period from the commencement date to the date of retirement as indicated in the schedule. The deferment period shall not be less than five years.

6. BENEFITS IN THE EVENT OF DEATH OR TOTAL AND PERMANENT DISABILITY BEFORE THE DATE OF RETIREMENT

In the event of the Death or Total and Permanent Disability of the Assured prior to the date of retirement, the Company shall, upon due proof of such death/disability, make payments to the beneficiary/s or Assured as described in the schedule.

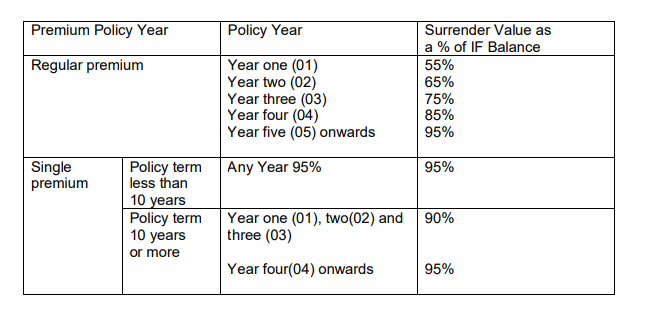

7. BENEFITS IN THE EVENT OF SURRENDER BEFORE THE DATE OF RETIREMENT

The policy can be surrendered by the Assured at any time before the date of retirement. In the event of the Assured surrendering the said Policy, the Assured will be entitled to recover an amount equal to a percentage of the balance lying to such Assureds credit in the IF, as set out below.

8. SETTLEMENT OPTIONS

Subject to these provisions, the whole or any part of the proceeds due to the Assured in settlement of this contract may be made payable in accordance with one of the following options set out below, or in any other manner that may be agreed upon with the Company. Once the Assured selects the specific settlement option, he/she shall be bound by it and such option shall be invariable.

Before any Settlement Option is made operative, this contract must be surrendered to the Company in exchange for a supplementary contract, which shall set out the terms and conditions applicable to the payments under the settlement option so selected by the Assured.

a) Lump sum Payment- 100% of the IF Balance could be withdrawn by the Assured on the date of retirement stipulated in the Schedule.

b) Payment of a Fixed Amount- Under this option the Company will pay a fixed amount to the Assured in annual, bi-annual, quarterly or monthly basis until the balance lying to his/her credit is exhausted.

c) Life income with payments guaranteed for a fixed term of years- Under this option, payments will be made in equal annual, bi-annual, quarterly or monthly basis for a fixed term and thereafter, as long as the Assured shall be alive. The amount of such payment will be determined by the assured’s sex, age as at the time the first payment becomes due and the annuity rates applicable at the time of exercising the option. The fixed term may be 5, 10, 15, 20 years or a period sufficient to refund the proceeds applied under this option. This option could also be obtained without a fixed term. In the event of the Assured dying within the fixed term referred to herein the beneficiary/s named will be entitled to receive such payments until the end of such fixed term.

d) Income for a fixed period- Payments will be made to the Assured or his/her beneficiary/s, if any, in equal annual, bi-annual, quarterly or monthly payments for a number of years varying from one year to thirty years. The benefits so payable will be based on the interest rate applicable at the time of exercising the settlement option, and will be fixed during the payout period.

9. MINIMUM BENEFITS

If the installments of the annuity payable in respect of the Assured under any of the settlement options is less than Rs 1000/- a month, the Company reserves the right to bring this contract to an end in respect of that Assured by making lump sum payment to the Assured or the beneficiary/s named there under and such sum shall be an amount not less than 95% of the balance lying to the credit of the Assured in the lF at the time of retirement of such Assured.

10. LOANS

A loan may be obtained on application, on the security of the policy if it is unencumbered. The loan shall not exceed ninety percent (90%) of such Surrender Value and shall be subject to the terms and conditions as the Company may determine from time to time. Any loan granted on the policy will be subject to deduction from any payment that may become payable under the policy.

11. STATEMENTS IN THE APPLICATION

All statements included in the application submitted by the Assured shall, in the absence of fraud, be deemed to be representations and not warranties.

12. MODIFICATIONS

Any amendment to the provisions included in this contract will be valid only when it is approved in writing by an authorised officer of the Company and the approval is endorsed on the contract or otherwise recorded as the Company may require. No agent or person other than an authorised officer, has the authority to change, modify or waive any provisions of this contract or to extend the time for paying any premia. The person entitled to benefits under this contract shall ordinarily, be the Assured, unless otherwise designated in the application or otherwise agreed between the parties and included by way of an endorsement subsequently.

13. BENEFICIARIES

The beneficiaries, if any, to receive the death benefit shall be designated in the application form. When any benefit becomes due by reason of the Assured’s death, the benefit will be paid to the beneficiaries who are alive at the time of death. However, if only one beneficiary is alive at such time, the entire benefit will be paid to such beneficiary.

If the person/s nominated as the beneficiary/s is/are not alive at the time of the death of the Assured, the benefits will be paid to the contingent beneficiary/s named by the Assured.

If no beneficiary/s or contingent beneficiary/s is/are alive at the time of the death of the Assured, such benefits will be paid to the estate of the Assured.

14. CHANGING OF BENEFICIARY/S

The Assured may, at any time during the term of the contract, change a beneficiary/s or a contingent beneficiary/s by filing a written request to that effect at the Head Office of the Company. Such change shall become valid only once it is endorsed upon the contract or it is otherwise recorded by the Company as it may deem fit. Upon such endorsement or recording, such changes shall be effective retrospectively and shall be deemed effective from the day on which the written request was filed regardless of the Assured being alive as at the date of the endorsement or recording of such change by the Company.

15. CLAIMS OF CREDITORS

Any amount due to the Assured or any beneficiary/s under this contract shall not be subject to any claims of creditors of such Assured or such beneficiary/s other than to the extent permitted by Law.

16. PREMIA

a) The premia shall be deemed to have been duly paid only when received at the Company’s Head Office or those of its other offices, which are duly authorized by the Company to accept payment of premia. The official receipt issued by the Company is the only valid evidence of payment of premia.

b) Besides the regular premia payable, the Assured will have the option to pay any top up premium amount at any point of time before the date of retirement of the Assured.

17. DESCRIPTION OF BENEFITS

The different types of option available under the contract are given under settlement options.

18. NON-PARTICIPATION

This contract is issued at a monthly accumulation rate which shall be determined by the Company each month as aforesaid and the benefits provided under this contract shall NOT include any sharing in the surplus earnings of the Company.

19. AGE AND SEX

This contract is entered on the basis of the age and sex certified by the Assured in the application. If the age and/ or sex have been mis-stated in the application, the amount payable under the settlement option selected by the Assured shall be adjusted to an amount on the basis of premia paid and according to the correct age and sex.

20. SETTLEMENT

If any settlement of this contract is effected by reason of death, surrender or otherwise of the Assured, at the time of such settlement, the Company will be entitled to deduct from the amount payable to the Assured, any amount that are due from the Assured to the Company. With the making of such payments, this contract will come to an end.

21. RIGHT OF CANCELLATION

The contract may be cancelled by returning the policy document and providing a written notice to the company within 21 days from the date of acknowledgment of the policy. In the event of such cancellation The Company will refund all the premiums paid during the period. If the policy is cancelled after 21 days, account balance will be paid.

22. TOTAL AND PERMANENT DISABILITY BENEFIT

Total and Permanent Disability benefit is payable on the occurrence of Total and Permanent Disability such that there is neither at the time of disability commences nor at any time thereafter, any work, occupation, trade, business, vocation or profession that the Life Assured can ever be capable of doing or following to earn or obtain any wages, compensation or profit provided, however, that such disability must continue for not less than six (06) months in duration, and if it is thereafter admitted as “Total and Permanent” for the purpose of this contract, the liability of the Company shall accrue as from the date of commencement of the disability.

Total and Permanent Disability benefit is payable on the occurrence of the following disabilities too:

a) Total Irreversible Loss of vision in both eyes or

b) Total and Permanent Loss or loss of use of two limbs at or above the wrist or ankle or

c) Total and Permanent Loss or loss of use of one limb at or above the wrist or ankle together with total and Irreversible loss of vision in one eye.

23. ACCIDENTAL DEATH BENEFIT

Bodily injury resulting, solely and independently of any or all other causes, from an accident caused by outward, violent and visible means which solely, directly and independently of all other causes, results in the death of the Life Assured within ninety (90) days of its occurrence, will be treated by the Company as an Accidental Death.

24. EXCLUSIONS (APPLICABLE TO ACCIDENTAL DEATH BENEFIT AND TOTAL AND PERMANENT DISABILITY BENEFIT)

The Company shall not be liable for Accidental Death Benefit and Total and Permanent Disability Benefit, if an event assured occurred under the following circumstances.

i. Intentional self-injury, suicide, attempted suicide, insanity, immorality, or whilst the Life Assured has consumed intoxicating liquor, drug or narcotic.

ii.An accident whilst the Life Assured is engaged in aviation or aeronautics in any capacity other than that of a fare-paying, part-paying or non-paying passenger in any aircraft which is authorized by the relevant regulations to carry such passengers and fly between established aerodromes.

iii. Injuries or death due to Life Assured being engaged in active Military, Naval, Air Force, Police or similar regimental force or organization.

iv. Injuries or death resulting from or sustained in any war or war-like operation (whether war be declared or not), Civil war, rebellion, insurrection, any terrorist activities, civil commotion, military or usurped power, riot, mutiny, invasion, act of foreign enemies or any act against any lawfully constituted authority, strikes or locked out workers acts.

v. Injuries or death resulting from or sustained in hunting, mountaineering or racing of any kind other than on foot and whilst practicing thereof, diving in any form, or in engaging in any underwater or in any subterranean operation.

vi. Injuries or death arising directly or indirectly as a result of any breach of Law, participating in or attempted performance of any criminal act, resisting arrest or any provoked assault.

vii. Injuries or death resulting from or sustained in nuclear reaction, radiation or nuclear or chemical contamination.

viii. Natural perils, avalanches, earthquakes, landslides, volcanic eruptions and any kind of natural hazards.

ix. Fraud - The Company may refuse payment of any claim in cases where the insured person or a person designated by him who is covered by this Policy.

a. has acted in bad faith or defrauded the Company or any other Insurer by deceitfully concealing facts or in any other manner or

b. has infringed the terms laid down in this Policy.

TERMS AND CONDITIONS OF THE INVESTMENT ORIENTED LIFE PLAN

1. PREAMBLE

AND WHEREAS Ceylinco Life Insurance Limited ( “The Company”) has agreed with the policyholder named in the schedule annexed to the policy of assurance and as per the privileges and conditions stipulated in the said Policy, to grant unto the said policyholder, the benefit/benefits more fully described in the said schedule on the date specified there in, subject to the payment of the premia therein stipulated.

The information disclosed by the assured in the proposal form together with all declarations, additional information and statements made in writing and signed by the assured shall be the basis of this contract of assurance.

The schedule annexed hereto shall form a part of this policy and shall be read and construed as part and parcel of this Policy.

The schedule annexed hereto shall form a part of this policy and shall be read and construed as part and parcel of this Policy.

2. PRIVILEGES AND CONDITIONS APPLICABLE TO THIS POLICY

2.1 RESIDENCE, TRAVEL & OCCUPATION

The schedule annexed hereto shall form a part of this policy and shall be read and construed as part and parcel of this Policy.

2.2 SURRENDER VALUE

This policy can be surrendered at any time during the term of the Policy and the net Surrender Value will be decided by the Company as shown in the Policy Schedule

2.3 LOANS

A loan may be obtained on application, on the security of the policy if it is unencumbered. The loan should not exceed ninety percent (90%) of the Surrender Value. Loans will be subject to the following terms and conditions:

a. Loan may be granted on proof of title to the policy.

b. The policy shall be assigned absolutely to and be held by the Company as security for repayment of the loan and the interest thereon.

c. The loan shall carry interest at the rate specified by the Company at the time when the loan is advanced. The said interest rate can be varied by the Company from time to time in accordance with the lending rates prevailing in the market at the relevant time. Arrears of interest due shall be compounded by the Company biannually.

d. The loan amount may be repaid at any time before a claim arises.

e. In the event of the policy resulting in a claim before the repayment of the loan in full with interest, the Company shall be entitled to recover the outstanding loan and interest due from any such benefit payable under the policy.

f. Where the outstanding loan amount together with the interest due becomes equal to the surrender value of the policy or such loan amount together with the interests due exceeds the surrender value of the policy, the Company will be entitled to treat the policy as surrendered.

2.4 APPOINTMENT OF BENEFICIARY

During the life time of the Life Assured and while this Policy is in force, the Policy Owner may by filling written notice satisfactory to the Company, appoint a beneficiary under this Policy or change a duly appointed Beneficiary at will. Subject to the provisions of any law a change of beneficiary shall be effective only if recorded by the Company. When the beneficiary is so changed and recorded, the change shall be deemed effective from the date of the written notice, notwithstanding the death of the Life Assured. The receipt by the beneficiary of sums payable by the Company shall constitute a valid discharge of the Company’s liabilities under this Policy and any acknowledgment of such receipt by the Beneficiary thereto shall be conclusive evidence of the same. If at the time of the death of the Life Assured there is no Beneficiary living then the amount payable will be paid to the Policy Owner or his estate. If the Policy Owner mortgages, charges or grants any other security interest in respect of this Policy, the rights of the Beneficiary will be subordinated to the rights of the person entitled to such security interest who will, to the extent of this interest, be entitled to receive the amount payable on the death of the Life Assured.

2.5 ASSIGNMENT

No assignment of this Policy shall be binding upon the Company unless written notice of the assignment is received and recorded by the Company. Upon receipt of any written notice of assignment the Company shall be entitled to require the production of all original documents for examination to the Company’s satisfaction before recording the assignment. The Company assumes no responsibility for the invalidity of any assignment due to the operation of Law.

2.6 CLAIM REQUIREMENTS

No money shall become due under the Policy until the Company’s requirements have been complied with. Any payment to be made under this Policy will be made at the Head Office of the Company. However, the Company is at liberty to nominate at its discretion an alternate place of settlement within Sri Lanka at any time before a claim is settled.

2.7 TOTAL EXCLUSION OF LIABILITY IN CERTAIN EVENTS

If the death of the Life Assured should occur as a result of his engaging in or participating in any way or in any manner in any war or any war like operation (whether war be declared or not) civil war, rebellion, insurrection, any terrorist activities, civil commotion, military or usurped power, riot, mutiny, invasion, act of foreign enemies or any act against any lawfully constituted authority, the Company shall not be liable to make any payment other than the Surrender Value of the Policy. Whenever the Company disclaims liability under the clause, the burden of proving that the death complained of was not occasioned or did not result from any of the causes referred to above shall be on the person claiming any benefit under the Policy.

2.8 SUICIDE

If the Life Assured should die by his own hand while of sound or unsound mind within one (01) year form the date of issue of the Policy, the liability of the Company is limited to refund of the premiums paid on the policy.

2.9 MISSING PERSON

Where the death of the life assured is sought to be established on the basis of a presumption generated in circumstances where he had not been heard of for a period of one year by those who would have naturally heard of him, if he had been alive, no money shall become due under the Policy until the effluxion of a period of 07 years computed from the time when the life assured had ceased to be heard of and this fact notified to the Company.

2.10 RIGHT OF CANCELLATION

The policy may be cancelled by returning the policy document and providing a written notice to the company within 21 days from the date of commencement of the policy. In the event of such cancellation, The Company will refund all the premiums paid during the period. If the policy is cancelled after 21 days, surrender value will be paid.

2.11 LAW AND INTERPRETATION

The Policy shall be governed by the laws the Democratic Socialist Republic of Sri Lanka. Where the context admits, reference to the Policy Owner, includes reference to his or her personal representatives and the singular includes the plural and the masculine includes the feminine and vice versa.

2.12 CURRENCY RULES

All premiums and benefits under this Policy are payable in Sri Lankan Rupees, lawful currency of Sri Lanka unless otherwise specified in the Schedule.

Notice

An agent will contact you to provide a customized solution.

Warning

Data will be cleared if you click continue. Do you really want to continue?